Understanding the Financial Market Landscape

The financial market is a complex ecosystem where various instruments, participants, and trading mechanisms interact to facilitate capital flow and investment opportunities. At its core, the financial market is categorized into several fundamental components, including stocks, bonds, commodities, and derivatives. Stocks represent ownership in publicly traded companies, and they can provide capital gains and dividends to shareholders. Bonds, on the other hand, are debt securities issued by corporations or governments as a means of raising funds. Investors purchase bonds with the expectation of receiving interest payments and the return of principal upon maturity.

Commodities, such as gold, oil, and agricultural products, serve as raw materials for the production of goods and services. They are essential for economic activity and can be traded on various exchanges. Derivatives, including options and futures contracts, derive their value from underlying assets and are primarily utilized for hedging risk or speculative purposes. Each of these components plays a crucial role in increasing profits through varying methods of investment and risk management.

The participants in the financial market can be broadly classified into individual investors, institutional investors, and traders. Individual investors are typically retail clients investing their personal funds, while institutional investors manage large portfolios on behalf of organizations, such as pension funds, mutual funds, and insurance companies. Traders, who may work for institutions or operate independently, engage in buying and selling securities, often capitalizing on short-term price movements.

Market exchanges provide a centralized platform where securities are listed and traded, ensuring transparency and liquidity. Additionally, over-the-counter (OTC) markets enable trading of financial instruments directly between parties without a formal exchange. To navigate this intricate landscape and optimize investment strategies for increasing profits, it is critical to conduct thorough market analysis. Both fundamental and technical analysis offer valuable insights into market trends and price movements, guiding investors in making informed decisions.

Developing a Strategic Investment Plan

Creating a well-defined investment strategy is fundamental to achieving financial goals and increasing profits in the financial market. The first step is to identify personal financial goals, which can vary from short-term needs, such as saving for a vacation, to long-term ambitions like retirement funding or wealth accumulation. Clarity on these objectives will guide investors in selecting appropriate investment vehicles that align with their aspirations.

Next, it is essential to assess one’s risk tolerance, which significantly influences investment decisions. Risk tolerance is determined by various factors, including age, income stability, and investment experience. For example, younger investors may be more inclined to take higher risks in pursuit of greater returns, while older individuals might prefer to prioritize capital preservation. Understanding one’s comfort level with risk will help tailor a strategic investment plan that supports both personal goals and psychological comfort.

Diversification forms another cornerstone of effective investing. By spreading investments across various asset classes—such as stocks, bonds, and real estate—an investor can mitigate risks associated with market volatility. This strategy is particularly important in uncertain financial conditions, as it helps shield the portfolio from significant losses in any single investment category. Additionally, investors should consider different investment strategies, including value investing, growth investing, and income investing. Value investing focuses on identifying undervalued companies, while growth investing targets businesses anticipated to grow at an above-average rate. Income investing, on the other hand, prioritizes investments that generate steady income, often through dividends.

Lastly, selecting the right investment strategy depends on individual circumstances, current financial conditions, and market trends. By taking the time to develop a comprehensive investment plan that encompasses these elements, investors can foster a solid foundation for increasing profits over the long term.

Implementing Risk Management Techniques

In the pursuit of increasing profits within the financial market, implementing effective risk management techniques is paramount. A robust risk management strategy not only safeguards investments but also aids in maximizing returns by minimizing potential losses. There are several key techniques that traders and investors can adopt to build a profitable position while managing the inherent risks associated with the market.

One of the most critical components of risk management is the establishment of stop-loss orders. These orders enable investors to set predefined exit points to limit losses on any given position. By determining a specific percentage of acceptable loss before entering a trade, individuals can mitigate the emotional impact of sudden market shifts. Stop-loss orders serve as a safety net, allowing traders to adhere to their strategies without succumbing to panic-driven decisions, thereby supporting the goal of increasing profits.

Another essential technique involves position sizing, which refers to determining the amount of capital allocated to a particular trade. Investors must assess their risk tolerance, account balance, and the potential volatility of the asset when deciding position size. By aligning position size with the overall risk management strategy, investors can ensure that any losses remain manageable and do not adversely impact their portfolio. This careful approach reinforces long-term financial stability while optimizing opportunities for profit.

Additionally, hedging strategies can be employed to further protect against potential market downturns. Hedging involves taking positions in other financial instruments to offset the risk of adverse price movements. Although it may seem counterintuitive, using hedges can help maintain a balanced portfolio during turbulent times, ultimately contributing to the goal of increasing profits over the long run.

Moreover, it is important to acknowledge the psychological factors that play a critical role in making risk management decisions. Fear and greed can significantly influence trader behaviors, often leading to impulsive actions that jeopardize profitability. By adhering to a well-defined risk management plan and maintaining discipline, investors can navigate the financial market with greater confidence, ensuring that risk is systematically managed and positioned for achieving favorable financial outcomes.

Evaluating Performance and Adjusting Strategies

Assessing investment performance is crucial for anyone looking to build a profitable position in the financial market. Key performance indicators (KPIs) play a significant role in determining how well an investment portfolio is performing over time. One such KPI is the return on investment (ROI), which measures the profitability relative to the amount invested. A higher ROI indicates more efficient use of capital and contributes positively to increasing profits.

Another important metric is the Sharpe ratio, which evaluates the risk-adjusted return of an investment. By comparing the excess return of an asset compared to a risk-free rate, adjusted for its volatility, investors can gain insight into whether the rewards justify the risks taken. Using metrics like the Sharpe ratio not only aids in identifying profitable investments but also enables investors to make more informed decisions consistent with their risk tolerance.

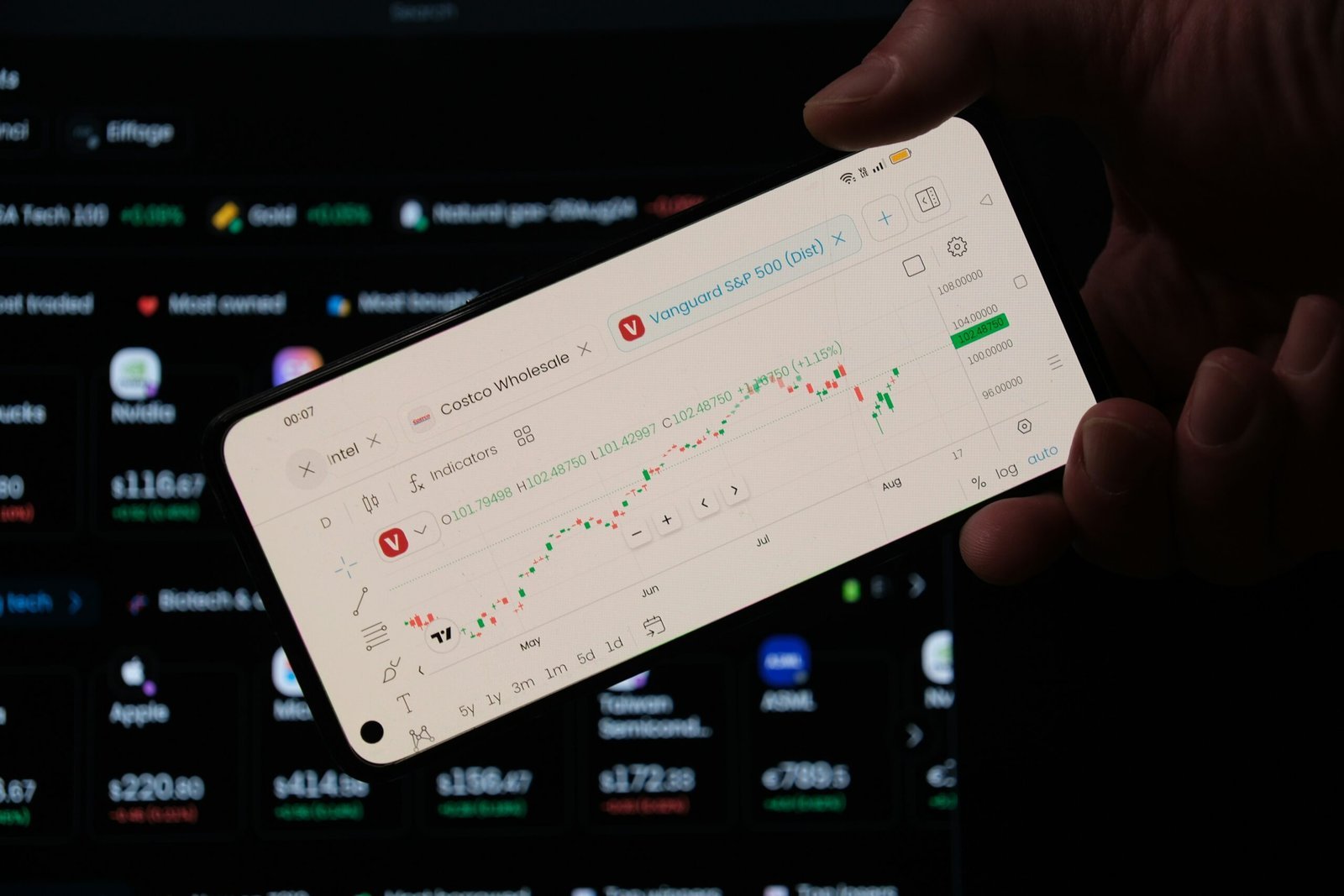

Alongside these KPIs, understanding the concept of relative performance is essential. This involves comparing one’s investment returns to a benchmark index, such as the S&P 500. By assessing whether an investment outperforms or underperforms this standard, investors can determine if they are on track to meet profitability goals. Regularly reviewing these benchmarks can highlight areas for adjustment, fostering the adaptability necessary in a volatile financial market.

To ensure that strategies remain effective, it is advisable to periodically review and adjust investment tactics. Market conditions are ever-changing, influenced by economic shifts, regulatory developments, and technology advancements. An investor’s strategy should reflect these dynamics to optimize long-term profitability. This proactive approach enhances the likelihood of increasing profits, regardless of market fluctuations.

In conclusion, a diligent evaluation of performance through established metrics and an adaptable approach to strategy adjustment are paramount for sustained success in the financial market.